[et_pb_section fb_built=”1″ _builder_version=”4.9.3″ _module_preset=”default” custom_padding=”0px||4px|||”][et_pb_row _builder_version=”4.9.3″ _module_preset=”default”][et_pb_column type=”4_4″ _builder_version=”4.9.3″ _module_preset=”default”][et_pb_post_title author=”off” date=”off” admin_label=”Post Title” _builder_version=”4.9.4″ _module_preset=”default”][/et_pb_post_title][et_pb_text _builder_version=”4.9.4″ _module_preset=”256683de-fd29-4c96-b2ea-2f610e293dd9″]

Wells Fargo where Fair Lending is just an Act?

The rationale Patrick Hellman an executive reporting to their CEO used used to avoid paying me fair compensation for all the problems they caused me was to point to the Fair Lending Act. This, he said, was the basis upon which he had to treat all complaints fairly by having a maximum payment of $500. However, I disagreed with his assertion and do not see anything wrong with the idea of paying varying amounts of compensation to people who were severely penalized by Wells Fargo incompetence. Imagine going to an expensive restaurant with five of your friends and having a truly terrible meal and when you complain the owner says you can have a free Coca-Cola or glass of wine as compensation because that is their fair way they handle all complaints. This it seems is how Patrick would manage his restaurant.

I looked into this Fair Landing Act and include a link to it here:

Fair Lending | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

From this I take it that if two married couples who have identical incomes go to Wells Fargo on the same day perhaps in two different towns in California, they should both walk away with the same interest rate for a loan assuming all other things being equal. That to me would be fair lending. From my experience it was far from that.

Last July, thinking we should refinance our WF loan as interest rates very much lower than we were paying. I emailed Wells Fargo as suggested by their website and received no reply. We visited one of their local offices where a member of staff gave my wife a quote of something like 3.5% interest on a REFI at a time interest rates were around 2%.

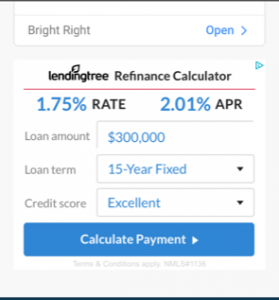

I had a contact in the mortgage business and asked him for a quote and after two weeks of some paperwork we were given a firm offer close to 2.5%. As I was also shopping around on the Internet to see what other rates were on offer I started getting pop up adverts almost every time I went online and some of these were as low as 2%. Here is a typical one now in March 2021. I was sure we could beat 2.5%. Now into August I called Wells Fargo and talked to a nice lady and I said I have been offered 2.5% but I see that some companies are offering 2%.

She said they would match the 2.5% I was offered provided I sent them the actual quote. I said that was a quote sent to me confidentially and was arrived at after a considerable amount of work. I said I do not think it is fair on this small company to provide you with their confidential information. I said to her I just want your best rate based on my financial status. She offered something like 3.35%. Is this the non-competitve rate many Wells Fargo customers accepted?

Her manager Cynthia repeated this insistence of seeing a confidential quote from another company and I repeated my insistence that that was unprofessional and unfair on any small businesses trying to compete with WF. All I wanted is for Wells Fargo give me their best rate based on my financial status. I ended up speaking to another manager and I simply asked him what was the best rate he has offered lately to someone with a similar financial status. He volunteered, rather surprisingly, that it was 2%. I went back to Cynthia and asked for that rate and again was refused. It seemed a few minutes after that conversation I get a pop up on my screen like the one above for 2% and I copied this to Cynthia asking her to match this rate and she did. The “points” were around 5/8%.

Her manager Cynthia repeated this insistence of seeing a confidential quote from another company and I repeated my insistence that that was unprofessional and unfair on any small businesses trying to compete with WF. All I wanted is for Wells Fargo give me their best rate based on my financial status. I ended up speaking to another manager and I simply asked him what was the best rate he has offered lately to someone with a similar financial status. He volunteered, rather surprisingly, that it was 2%. I went back to Cynthia and asked for that rate and again was refused. It seemed a few minutes after that conversation I get a pop up on my screen like the one above for 2% and I copied this to Cynthia asking her to match this rate and she did. The “points” were around 5/8%.

Now the question I have is this fair lending? How many people would know how to do what I did? I do not want to come across as some smart a.. but I have had many years in sales and marketing and a good deal of experience in negotiating. I consider myself a hopeless cook, ignorant car mechanic and would be useless around the house doing any kind of do-it-yourself jobs. I am sure many of those people with those skills save a fortune negotiating jobs around the house or by knowing how to discuss auto related issues. However, negotiating with Wells Fargo was something I was comfortable with.

If you are thinking about a mortgage or refinance, I would search the Internet to make sure you start seeing low interest pop-ups ads. Take a copy and take it to Wells Fargo and ask them to match it and you can show them this website. If you are reading this and have recently taking out a loan with Wells Fargo and perhaps you are not impressed with the rate you are getting go back to them with a pop up ad request this rate. Do not accept no for an answer. Do not click the pop up ad either as completing any form they offer is likely to result in your details being sold to scores of companies. Find a reputable mortgage company and ask for their best rate.

I am sure you may will be hit by a wall of silence or astonishment at such a suggestion but escalate. If this does not work, go to the section on complaining to Wells Fargo and I hope you will see a roadmap to some success.

What I hope comes out of this is that Wells Fargo offers everyone their best rate based on your financial status and not one you have to ask some other company to give you so Wells Fargo can match it.

During the Covid19 crisis millions of people have sought REFI deals many desperate to reduce or defer debt perhaps due to losing their jobs or businesses. I speculate that many people simply took what Wells Fargo offered never questioning the rate offered. Again, pure speculation but did Wells Fargo take advantage of these people? Many I am sure come from all segments of society, religions, races and income levels. Did they all get Fair Lending or was it all an act?

One thing to watch out for even if you get the low interest rate quote is how many points, they are going to charge you. You may already know one point is 1% of the loan as a fee so if you are borrowing $300,000 with 1% “points” there is a $3,000 fee on top of all the other fees banks charge. They will want to charge you a fortune for a survey of your home likely marking up the fair value value of a survey by up to 300%. Do question all the fees.

[/et_pb_text][et_pb_button button_url=”@ET-DC@eyJkeW5hbWljIjp0cnVlLCJjb250ZW50IjoicG9zdF9saW5rX3VybF9wYWdlIiwic2V0dGluZ3MiOnsicG9zdF9pZCI6IjIxIn19@” button_text=”Read More” button_alignment=”right” _builder_version=”4.9.3″ _dynamic_attributes=”button_url” _module_preset=”default” custom_button=”on” button_text_color=”#FFFFFF” button_bg_color=”#919191″ button_border_width=”0px” button_border_radius=”10px”][/et_pb_button][et_pb_comments _builder_version=”4.9.3″ _module_preset=”default”][/et_pb_comments][/et_pb_column][/et_pb_row][/et_pb_section]